May 24, 2024 By: JK Tech

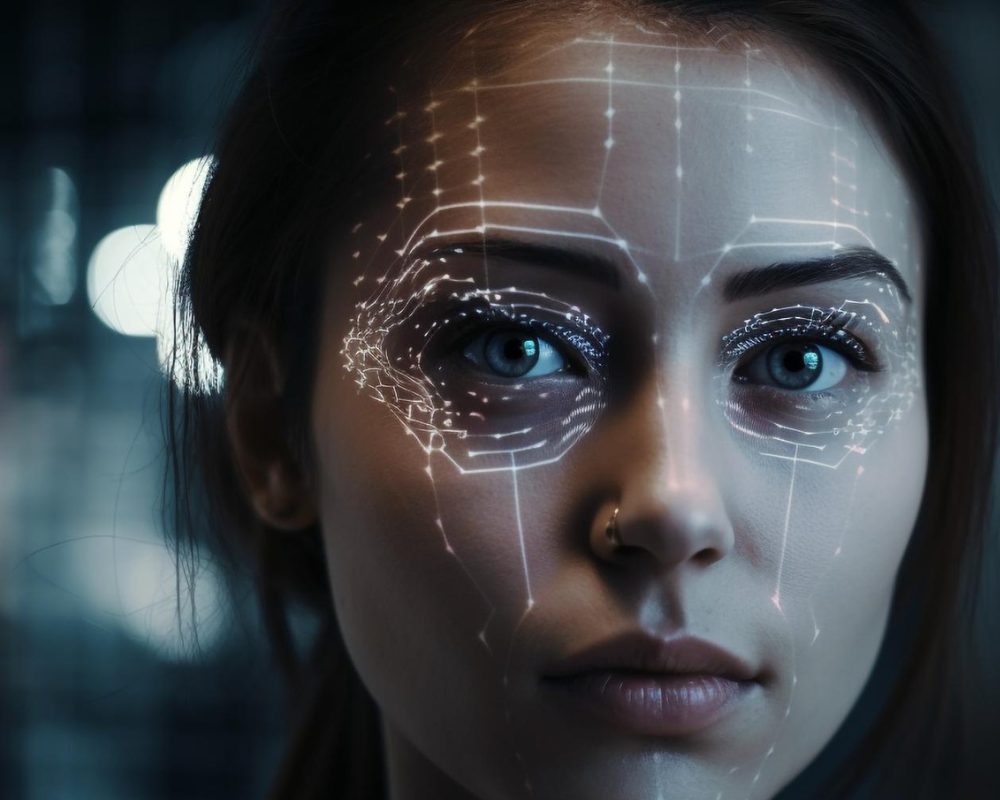

The way we pay is on the verge of a significant transformation. Biometric payment options, like facial recognition, are gaining traction, promising a checkout experience as easy as a smile. Major players like JPMorgan Chase and Mastercard are joining the scene, following the lead of fast-food chains and retailers who have already begun using this technology.

This convenience comes with a cost: privacy concerns. Consumers worry about companies collecting and storing sensitive biometric data. Despite these concerns, experts predict a boom in biometric payments, driven by the ease of use and potential security benefits. Supporters argue that biometric data is more difficult to steal than traditional passwords or credit cards. Also, younger generations, especially Gen Z, seem more comfortable with this technology compared to older demographics.

But a recent incident involving a deepfake scam that swindled a whopping $25.6 million from a Hong Kong bank has sent shivers down the spine of cybersecurity experts. This raises a critical question: are our biometric security systems vulnerable to the ever-evolving world of deepfakes?

Deepfakes are fake videos made with AI that look real. They can show someone saying or doing things they never did. In the case of the Hong Kong bank, cybercriminals used deepfakes to impersonate the bank’s CFO and colleagues during a video call, tricking an employee into authorizing a fraudulent money transfer.

The primary types of deepfake attacks include presentation attacks and injection attacks. Presentation attacks involve fooling the scanner with a fake image, video, or 3D mask. Injection attacks involve manipulating the data stream between the scanner and the authentication system.

So how do we fight back against these deepfake tricksters? Security systems are increasingly incorporating liveness checks, a kind of digital handshake that confirms the biometric data comes from a real, living person. Some liveness checks are passive, working behind the scenes to analyze factors like skin texture or blood flow in a fingerprint scan. Others are active, requiring users to blink, smile, or turn their head at specific prompts.

The future of biometric payments hinges on balancing convenience and security. Multi-layered security systems combining liveness checks, anti-spoofing algorithms, and data encryption can defend against deepfakes and other attacks.

The fight against deepfakes is ongoing, but with the right approach, biometric payments can offer a secure and convenient way to pay. It offers a glimpse into a future where paying is as easy as a smile. However, addressing privacy concerns and continuously improving security measures are crucial for earning consumer trust. By implementing strong safeguards, biometric payments can become a secure and convenient way to manage our finances.