The Client

The client is a dedicated and customer-focused underwriter with a mission to empower independent title agents and safeguard residential and commercial property owners through secure title insurance. Committed to fostering trusting, collaborative, and mutually beneficial relationships with a nationwide network of agents, the client stands out by refraining from competing against independent agents and channeling all resources into assisting them in lowering risks, decreasing costs, and fostering business growth.

The Challenges

- High turnaround time

- Less Accuracy in manual process

- Dependency on outdated generic rate calculators

The Objective

The objective was to generate the premium for any title insurance policy using an application that minimizes the cost and time of the in-house team and their agents. It should also reduce the chances of manual error and can be updated easily by the client’s in-house users. The aim was to reduce the dependency on generic rate calculators which can be outdated or error prone.

The Solution

- JK Tech collaborated with the client to design and develop a specialized application for calculating title insurance rates.

- The application utilizes a set of rate cards, designed for ease of use, allowing business users to update rate calculations as per the latest rates manual version.

- In-depth analysis of user manuals for 14 states was conducted to understand and derive all possible rate calculation scenarios.

- Rules for rate calculations were established based on specific scenarios and seamlessly integrated into the rate cards.

- Two versions of the application were created: a desktop-based version for the client’s in-house team and a web-based version for agents.

- The desktop app empowers in-house users to perform rate calculations and update rate cards if needed.

- The web application is user-friendly for agents and enables them to calculate premiums but restricts them from updating the rate cards.

- Overall, the solution ensures a comprehensive and user-friendly platform for efficient title insurance rate calculations.

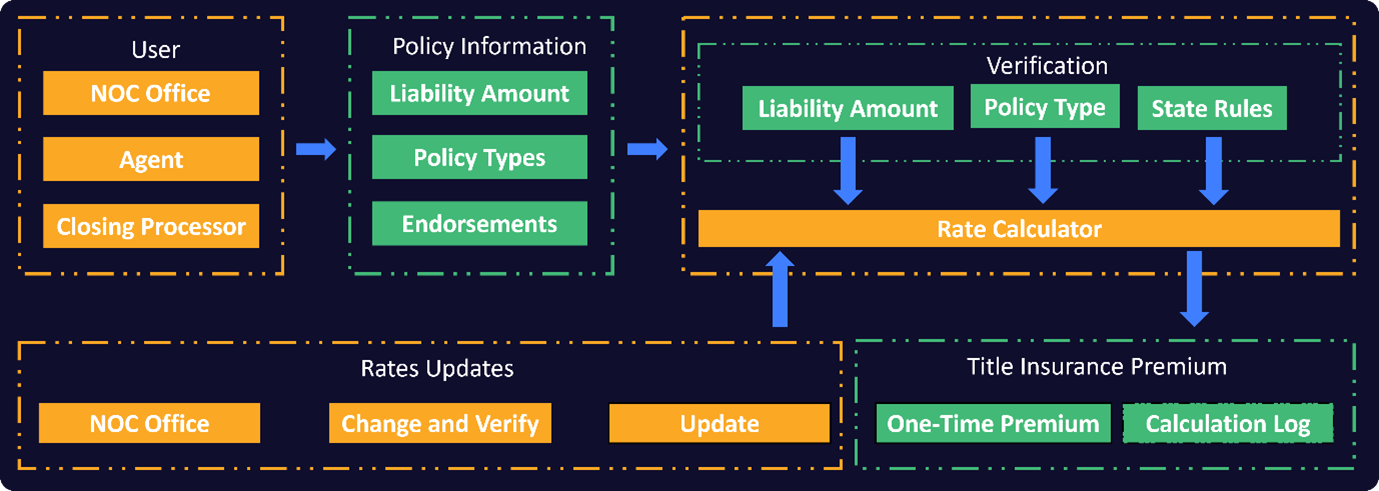

Business Process Diagram:

The Benefits

- Accelerated Accuracy: Enabled Client’s in-house team and agents to swiftly and accurately calculate title insurance rates.

- Compliance Assurance: Averted regulatory fines by ensuring precise premium charges, and preventing discrepancies in customer billing.

- Dynamic Rate Management: Empowered authorized people to easily update rate cards as needed and save valuable time.

- Error Elimination: Eliminated manual processes, significantly reducing the risk of errors in premium calculations.