The Client

The client is one of the leading award-winning business finance providers in the UK. They are on a mission to transform small business funding through technology, data and global partnerships. They expanded their business in the United States of America and are driving expansion in Nordic countries and the rest of Europe.

The Challenges

The client desired to have an optimized Salesforce system to drive expansion and business growth and that would simplify their complex and dynamic processes. The Client was looking for a low code solution, which involves visual modeling development tools and readymade components that significantly reduce the amount of hand-coding. This strategy would scale up their business without major effort. In addition to that, they were also looking for a better user experience to make the system more interactive and user-friendly.

The Objective

The client aimed at providing a simple, robust and fair finance solution to their customer through transformative technology. Thus, they sought to have a configurable and scalable solution so that they can expand their business worldwide without major efforts. The client was seeking an IT service and solution partner who would have a deep understanding of the current technology trends and would drive the business towards successful expansion and growth.

The Solution

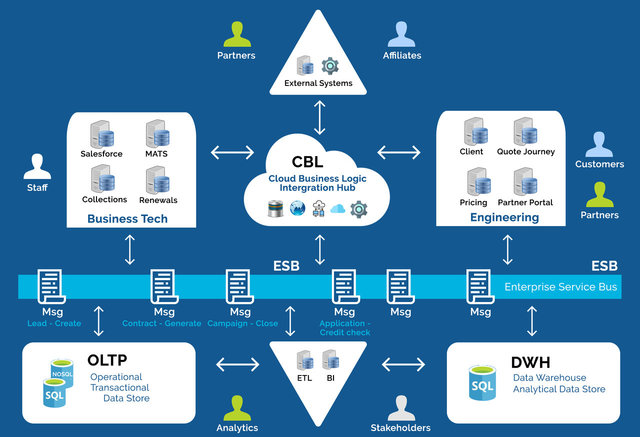

To overcome the business challenges and optimize Salesforce systems for continued growth, the following solutions were provided:

- Salesforce ORG expansion and migration of business functionality helped provide existing solutions as a template.

- Implementation of scalable sales to improve lead qualifications through third-party agent’s application, the goal was to use a minimum or no-code solution using different Salesforce automation features like Process Builder and Lightning Flow.

- Boosting incoming leads through an application programming interface (API) Integrations with Partners and Affiliates.

- New Voice Media (Contact world) CTI integration was done, which connected customers through existing telephone infrastructures and using the internet to pass along previously collected client information to agents.

- Azure ESB integration with Salesforce for transactions/repayments done by customers. Now, the client collected the repayments on loans through terminals (Credit/Debit) machines of respective banks into Salesforce which is synched overnight to data warehouse through Azure ESB.

- Automated lead conversions through the online journey from lead generation to funding. The client had their own in-house developed online website that generates leads to Salesforce, where the pre-sales process is done.

- Accepting and scheduling payments from customers through a third third-party payment app: With this payment gateway client can schedule recurring payments that were to be collected from customers on a daily, weekly and monthly basis according to the split percentage which is agreed upon.

- Adobe e-sign integration for signing agreements: Automation of sending agreements for digital signature for the loan they have applied once their credit check and underwriting decisions are approved.

- Open Banking integration with Salesforce: Open banking allowed paperless banking experience for customers.

- Lightning migration and use of Lightning web components for better User experience.

- Experian Consumer/Business search from Salesforce through API integration for us.

The Benefits

- Efficient leads management through Internal and External agents using a scalable sales process leading to a productivity improvement > 15%.

- One-stop solution for all queries through salesforce for customers (Leads – Funding – repayments – Closure of Loan).

- Customers now don’t have to provide Bank statements to the client, due to the Open Banking integration, thus eliminating delays.

- Lightning Experience has helped fasten the funding process by roughly 20%.